The role of hydrogen towards decarbonisation: the Italian pipeline in a study by Enea and Confindustria

In the path towards decarbonization, hydrogen as an energy vector will play a key role for economic growth and European competitive development. A study born from the collaboration between Confindustria and Enea and made public in recent days analyzed the Italian supply chain and the potential for penetration and diffusion of the use of hydrogen in Italy

Exactly one year ago, on 22 January 2021, Enea and Confindustria signed a Memorandum of Understanding aimed at enhancing the technological leadership of the Italian industry in the hydrogen sector. In recent days, a study born from this collaboration was published and confirms what is expressed in the strategic agendas "An EU Strategy for Energy System Integration" and "A Hydrogen Strategy for a Climate-Neutral Europe" at European level and in the Strategia Nazionale Idrogeno - Linee Guida Preliminari in Italy that sets short, medium and long-term objectives to foster development, evolution and stability in the technological, legislative, regulatory and economic-financial fields and provides for a penetration of hydrogen in final energy consumption of approximately 2% by 2030 with an increase of up to 20% by 2050.

A path of meetings and dialog between research and industry

The collaboration between research and industry, born from the joint work of Confindustria and Enea from which the study in question was born, aims to identify innovative solutions and possible operational scenarios to support actions and initiatives to reduce the energy supply costs of the industrial system.

The study investigates the potential for penetration and diffusion of the use of hydrogen in Italy in the various industrial sectors and proposes a mapping of potential industrial Off-Takers by identifying among the main parameters that differentiate the various sectors the extent of potential consumption of hydrogen per year and the degree of technological/commercial readiness.

Many industrial segments (such as refineries, chemicals, petrochemicals, non-ferrous metals and iron and steel) have been using hydrogen for some time and are therefore more prepared for use in production processes. Others are already adaptable from a pre-commercial point of view (such as the heat sector and residential boilers), while others still need a technological development that would make it possible to make the most of the high potential for use of hydrogen (such as concrete, paper, glass, ceramics, mobility and logistics).

The assessment of the technical feasibility of the use of hydrogen in different sectors of the industry and the mapping of potential Off-Takers was developed through the involvement of the main stakeholders belonging to the hydrogen value chain, in a process of meetings and dialogs coordinated by Confindustria and ANIMA.

The possible application scenarios that have emerged are varied: some consider the use of hydrogen mixed with natural gas in varying concentrations up to 20% by volume. Other scenarios and applications provide for its use up to 50%.

Main criticalities for the creation of a hydrogen pipeline

The survey conducted by Enea and Confindustria took into consideration some factors such as

- The potential in quantitative terms of replacement (partial or total) of natural gas with hydrogen in industrial processes as a substitute for fuel to provide process heat in Hard To Abate sectors where direct electrification is not possible and in the residential sector. Potential intended as an impact on the decarbonisation of individual sectors, also through the estimate of the amount of CO2 not emitted, highlighting, where present, the technological criticalities related to the use of hydrogen. According to a Boston Consulting Group (BCG) study, the Hard to Abate (HtA) sectors falling within the analyzed context (chemicals, steel, cement, paper, ceramics, glass and foundries) play a key role in the Italian industrial fabric, representing a fundamental link in the supply chain. which involves other sectors in supply relationships.

- The potential of the use of hydrogen in the mobility sector.

The lack of legislative uniformity, as well as of reference standards, of economic incentives, but also of adequate distribution systems are some of the criticalities that the study highlights in various sectors.

Another significant obstacle is represented by the current lack of competitiveness of the hydrogen supply chain both in terms of investment costs, such as that necessary for changing the technologies used, and in terms of incremental variable costs for the purchase of hydrogen compared to at the cost of the fuel replaced, net of the specific abatement costs per ton of CO2. For a detailed analysis of the investment costs for technological adaptation by the end user, we recommend reading the Hy4Heat Conversion of Industrial Heating Equipment to Hydrogen (2019) produced by Cardiff University and Hy4Heat.

With regard to the specific sector of manufacturers of valves, fittings and couplings, the study highlighted a significant potential interest in the use of hydrogen as a fuel, given the fact that the systems and devices produced are involved transversally in all production sectors, both the traditional Oil & Gas and the civil sector.

In this field, the main barriers identified for the use of hydrogen are:

- Lack of tests and experience in the field in the short and long term, in some uses along the value chain in particular, with the aim of preserving the security of the systems.

- Lack of a reference regulatory framework related to testing protocols.

- Absence of defined limits for the use of hydrogen in natural gas.

In this regard, we suggest reading our article on the benefits of high pressure testing and the page dedicated to Interfluid testing units.

Towards a national strategy for the decarbonisation of the energy sector

The study by Confindustria and Enea continues by highlighting, for each target sector (steel, refining, glass, ceramics, chemicals, paper, non-ferrous metals, foundries, food, cement and civil heating) a table that analyzes the economic aspects, consumption of natural gas, and the impact and maturity of the sector by examining parameters such as hydrogen needed as a function of blending, overall power of the electrolysers and quantity of CO2 avoided.

In order to make hydrogen an integral part of a national strategy towards the decarbonization of the energy sector, some enabling actions are necessary, investigated in the study, highlighting the technological, regulatory and, in particular, economic aspects, with different levels of criticality depending on the sector considered. The data collected made it possible to identify the main sectors of application of the hydrogen vector, quantify the interventions and identify the actions to be implemented.

The sectors with the greatest potential for hydrogen consumption were the paper, steel, chemicals, ceramics, cement and glass sectors.

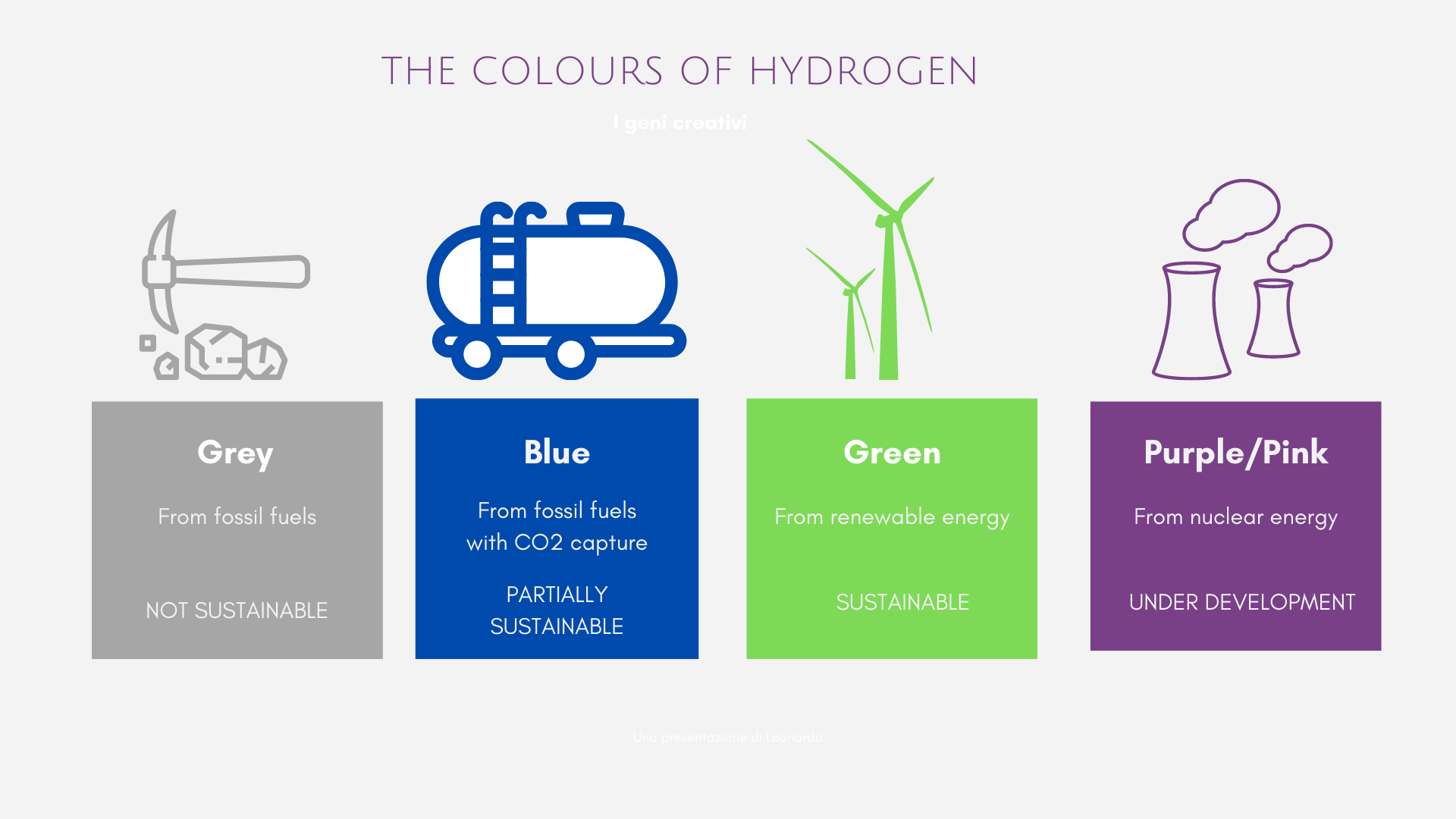

To date, the consumption of hydrogen in Italy is almost entirely limited to the chemical, petrochemical and refining sectors with a prevalence of gray hydrogen produced in large natural gas steam reforming plants to directly feed the processes. The evolution hypothesized for the future of these sectors is towards more sustainable hydrogen production processes such as the implementation of electrolysis (green hydrogen) or reforming with capture and storage of CO2 (blue hydrogen).

The question of how the demand can be satisfied in terms of production in the necessary quantity and continuity of service remains unresolved by investing in transport, storage and distribution on the territory.

The question of how the demand can be satisfied in terms of production in the necessary quantity and continuity of service remains unresolved by investing in transport, storage and distribution on the territory.

On the basis of the information collected during the meetings, it was finally hypothesized the constitution of potential pipelines that could be implemented in the context of the national industry and whose establishment in the so-called Hydrogen Valleys would allow the identification of technologies, guidelines and good practices, as well as the authorization processes necessary to integrate hydrogen consumption and production.